TikTok finance influencers have gained popularity among Gen Z by offering advice on how to achieve quick wealth. As economic insecurity heightens anxiety within this generation, young people are increasingly seeking alternative sources of guidance to navigate and overcome a flawed system.

A wave of 'hustle bro' influencers has carved out a niche on TikTok, gaining popularity by promoting often radical financial advice. These influencers, many of whom claim to have achieved substantial profits through trading, advocate for investments in areas like the forex market and cryptocurrency as pathways to financial freedom. Rooted in the belief that traditional career paths are restrictive and unrewarding, this content often doubles as a marketing tool for exclusive investment courses.

Growing up amid global economic instability has led to high levels of financial stress among young adults. More than half of Gen Z respondents in a 2023 EY study reported feeling "extremely worried about not having enough money." With trust in institutions at an all-time low, young people are looking for alternatives to what they view as a flawed system, seeking more autonomous ways to manage their work, finances, and lives.

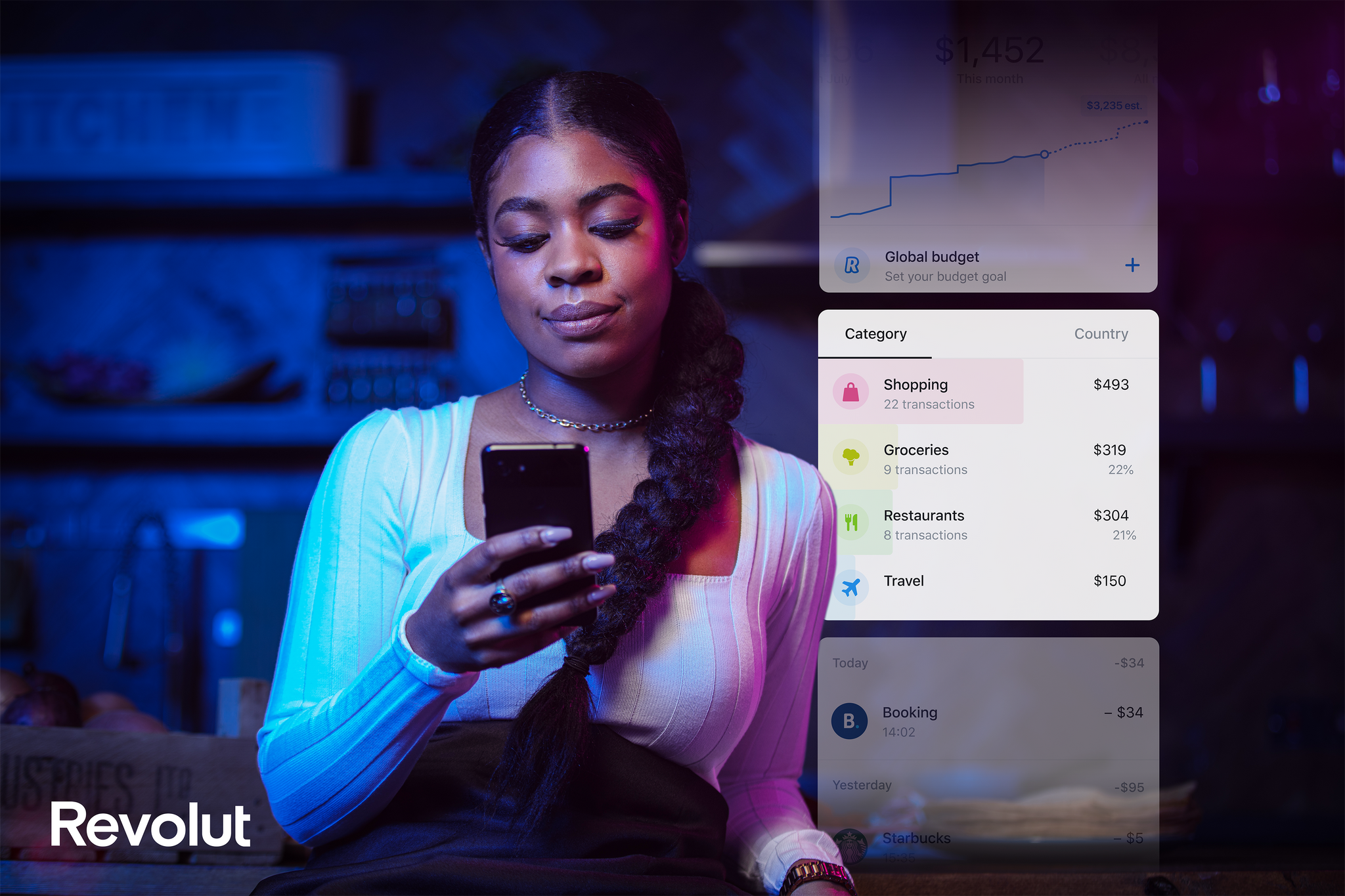

For example, while the FIRE community promotes extreme strategies for early retirement, some young Americans are embracing poly-employment to hedge against potential layoffs, and TikTok homesteading influencers are advocating for fully off-grid, self-reliant lifestyles. Brands can assist young people in navigating economic insecurity by offering reliable and credible expertise, thereby providing safe financial guidance and helping to combat misinformation in an era where trust in traditional institutions is waning.