Is luxury in flux?

Luxury spending is on the decline. LVMH's net profit dropped 14% from €8.48bn to €7.27bn for the first half of the year. Shares in Kering were down more than 4% as group revenues fell 11% in the first half of the year to €9bn., Michael Kors revenue of $675 million decreased 14.2% on a reported basis and Hermès International, Burberry, Coach owner Tapestry Inc, Richemont and Brunello Cucinelli all saw their value slip on stock markets.

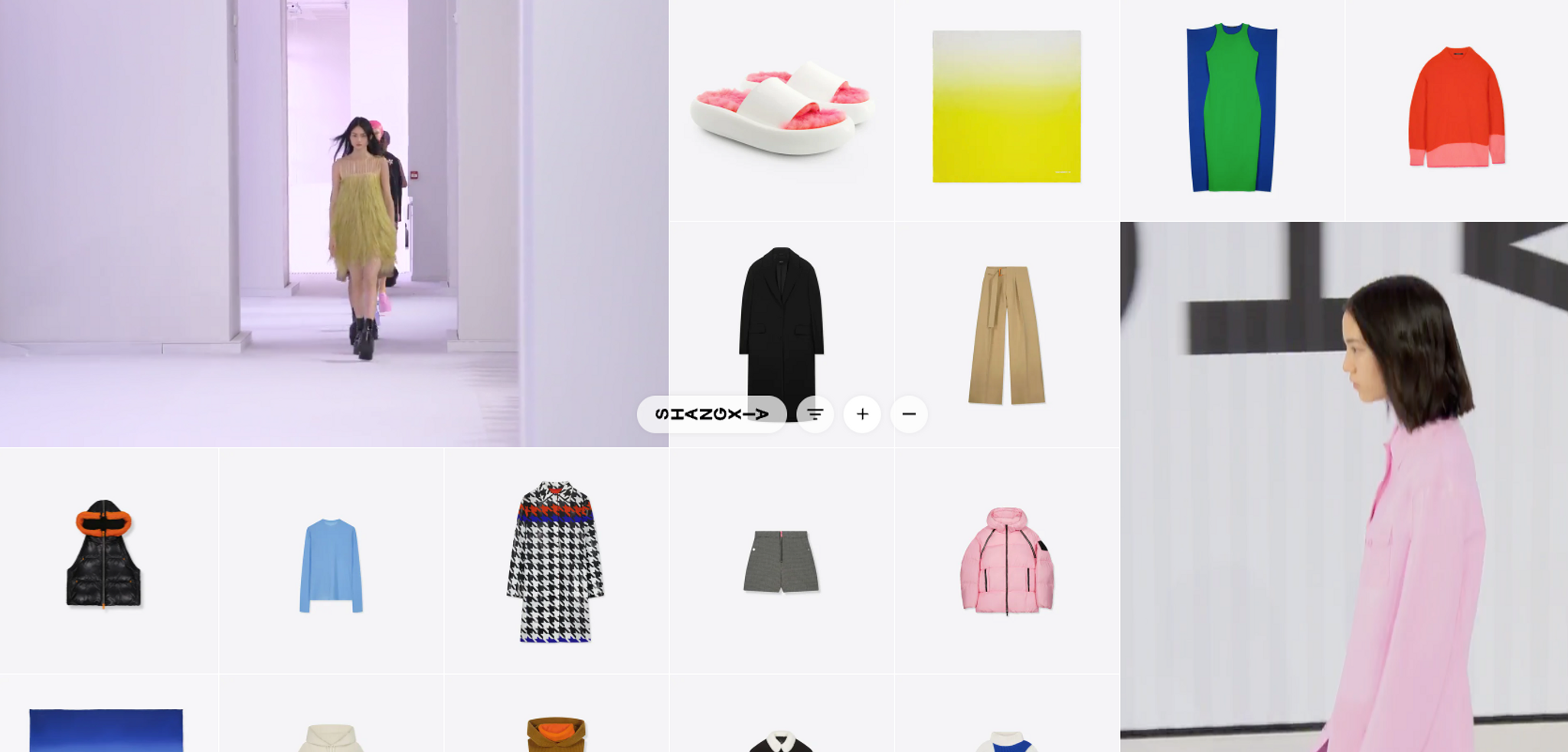

The RetailX European Luxury 2024 report stresses that part of the decline in luxury spending lies with inflation. “Shaken consumer confidence saw a reduction in spending across the board, with luxury – very much a discretionary spend – being one of the hardest hit sectors,” writes Katie Searles for Internet Retailing. With clothing (59%) being one of three most common cost-cutting targets for those reducing non-essential spend, spending less on luxury or changing ideas around what people are willing to spend on could be key - particularly as we see a shift towards experiential spending. This change, led by Gen Z and millennials, sees people willing to spend more on experiences (such as travel and dining) rather than on luxury goods. This change reflects a broader cultural shift as people take to experiences over tangible items with Millennials and Gen Zers more likely to value experiences over physical possessions.

How can brands tap into these changing consumer habits? Opting for experiential luxury offerings is one way to tap into a desire for experiences that merge with luxury goods. British car brand Jaguar did just that by tapping into HNWIs love of slow experiences and offering more indulgent IRL interactions. Meanwhile, Loewe’s immersive exhibition tapped into the heritage and history of the brand, allowing people to explore the products and the brand’s history through a curated experience.